In the world of travel rewards, two cards consistently stand out from the pack as the undisputed champions of the mid-tier.

In one corner, the long-reigning fan favorite, the Chase Sapphire Preferred® Card. In the other, the powerfully simple challenger, the Capital One Venture Rewards Credit Card.

Both are fantastic choices that can turn your everyday spending into your next vacation, but they are built for fundamentally different types of travelers. Choosing between them isn’t about finding the “better” card—it’s about finding the better card for you.

Let’s break down this heavyweight match, round by round, to help you decide which card deserves a place in your wallet.

Trippin’ Tale: At a Glance

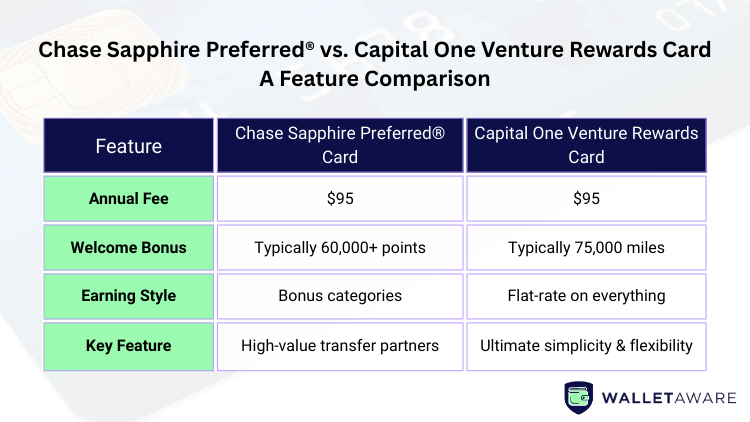

Here’s how the two contenders stack up on their key features.

| Feature | Chase Sapphire Preferred® Card | Capital One Venture Rewards Card |

|---|---|---|

| Annual Fee | $95 | $95 |

| Welcome Bonus | Typically 60,000+ points | Typically 75,000 miles |

| Earning Style | Bonus categories | Flat-rate on everything |

| Key Feature | High-value transfer partners | Ultimate simplicity & flexibility |

(Offers are current as of September 2025. Please visit the issuer’s website for the most up-to-date terms and conditions.)

Round 1: Earning Rewards

How you rack up rewards with these cards is a classic matchup of strategy vs. simplicity.

Chase Sapphire Preferred: This card is for the maximizer. It rewards you for spending in specific bonus categories:

- 5x points on travel purchased through the Chase Travel℠ portal

- 3x points on dining, online grocery stores, and select streaming services

- 2x points on all other travel purchases

- 1x point on everything else

Capital One Venture: This card is for the simplifier. It offers a clean, easy-to-track earning rate on every single purchase, with no categories to remember:

- 2x miles on every purchase, everywhere

- 5x miles on hotels and rental cars booked through Capital One Travel

The Verdict: This round is a draw, and the winner depends entirely on your spending habits. If your budget is heavily weighted towards dining out and travel, the Sapphire Preferred will likely earn you more points. If your spending is spread out across a wide range of categories (like home improvement, gas, or general retail), the Venture Card’s simple 2x on everything will come out ahead.

Round 2: Redeeming Rewards (The Main Event)

This is the most important round and where the cards’ core differences shine.

Chase Sapphire Preferred: The power of Chase Ultimate Rewards® is flexibility and high potential value.

- Chase Travel℠ Portal: Your points are worth a fixed 1.25 cents each when you book flights, hotels, or cars through the Chase portal. This makes your 60,000-point bonus worth a guaranteed $750 toward travel.

- Transfer Partners: This is the card’s signature move. You can transfer your points at a 1:1 ratio to over a dozen airline and hotel partners. Moving 60,000 points to World of Hyatt could get you two nights at a luxury Park Hyatt hotel worth $1,000 or more, netting you a much higher value.

Capital One Venture: The power of Capital One Miles is simplicity and freedom.

- Purchase Eraser: This is the card’s hallmark feature. You can book a flight on any airline or a room at any hotel using your card, and then log into your account and “erase” the purchase with your miles at a fixed value of 1 cent per mile. No blackout dates, no portals, no fuss.

- Transfer Partners: Capital One also has its own list of airline and hotel transfer partners. While it lacks a standout hotel partner like Hyatt, it has many valuable international airline partners that can be great for savvy travelers.

The Verdict: The Chase Sapphire Preferred wins for value maximizers. If you’re excited by the idea of learning about transfer partners to squeeze every bit of value from your points (especially with Hyatt), this card is unbeatable. The Capital One Venture wins for travelers who crave simplicity and flexibility. If you want to find the cheapest flight on Google Flights or stay at a boutique hotel and know you can cover the cost with your miles, this card’s freedom is unmatched.

Round 3: Benefits and Perks

Beyond points and miles, these cards offer tangible benefits that can easily justify the annual fee.

Chase Sapphire Preferred:

- $50 Annual Hotel Credit (for hotels booked through the Chase portal)

- Primary Auto Rental Collision Damage Waiver (a rare and valuable perk)

- Excellent trip cancellation/interruption and baggage delay insurance

Capital One Venture:

- Up to $100 credit for Global Entry or TSA PreCheck®

- Two complimentary airport lounge visits per year to Capital One Lounges or Plaza Premium Lounges

The Verdict: Another close round that depends on your needs. The Sapphire Preferred is the clear winner if you value peace of mind through its robust travel insurance and primary rental car coverage.

The Venture Card wins if you value speeding through airport security and having a couple of lounge visits each year.

The Final Decision: Which Card is in Your Corner?

There’s no wrong answer here, only the right answer for your travel style.

Choose the Chase Sapphire Preferred® if…

- You are a “maximizer” who enjoys the game of points and travel partners.

- Your spending is heavily focused on dining and travel.

- You see the immense value in transferring points to partners like World of Hyatt and Southwest.

Choose the Capital One Venture Rewards® if…

- You are a “simplifier” who wants an easy-to-understand rewards program.

- Your spending is spread across many different categories.

- You want the ultimate freedom to book travel wherever you want and use your miles to cover the cost.

Whichever you choose, you’re getting a best-in-class travel card. By understanding how they differ, you can confidently pick the champion that will best help you see the world.

Frequently Asked Questions (FAQ)

What’s the real difference between a “point” and a “mile”?

In this context, it’s mostly just branding. Both are flexible rewards currencies offered by the bank. The more important factor is not the name, but how they can be redeemed.

Do I need an excellent credit score for these cards?

Yes. Both of these cards are considered premium travel cards and generally require a good to excellent credit score for approval, typically 690 or higher on the FICO scale.

WalletAware shares education, not individualized financial advice. Always confirm current terms on the issuer’s site before applying.