Let’s be honest: the word “budget” can sound miserable. It brings to mind complex spreadsheets, tracking every single penny, and feeling guilty about buying a cup of coffee.

Most traditional, line-by-line budgets are so rigid that one unexpected car repair can make you feel like a failure and throw the whole system out the window.

What if there was a simpler way? A way to manage your money that provides clarity and control without the stress and guilt?

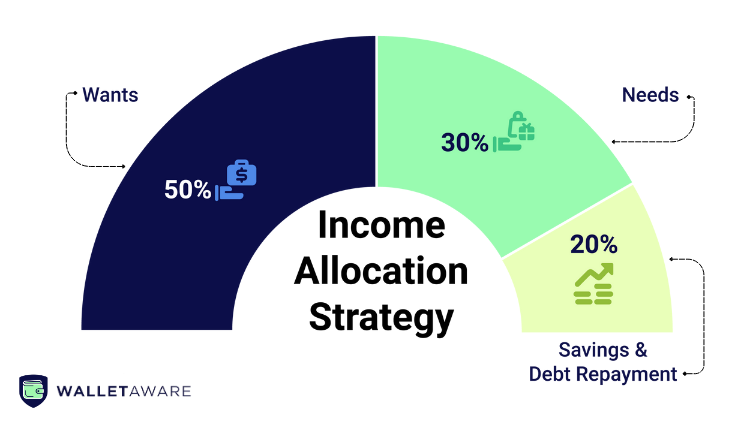

Enter the 50/30/20 rule.

It’s less of a strict budget and more of a simple, flexible spending plan. Popularized by Senator Elizabeth Warren in her book, “All Your Worth: The Ultimate Lifetime Money Plan” this framework has helped millions of people get a handle on their finances because it’s easy to understand, adaptable, and—most importantly—it actually works.

What is the 50/30/20 Rule?

The big idea is to divide your after-tax income into just three categories. Instead of tracking dozens of expenses, you only have to worry about three buckets: Needs, Wants, and Savings.

Your Starting Point: The first step is to figure out your after-tax (or take-home) income. This isn’t your total salary; it’s the actual amount of money that gets deposited into your bank account on payday after taxes, 401(k) contributions, and health insurance premiums have been taken out. This is the number you’ll be working with.

The 50% Bucket: Your Needs

Definition: Your “Needs” are the essential, must-have expenses required to live. If you stopped paying these, there would be immediate, serious consequences.

No more than 50% of your take-home pay should go toward these items.

Examples of Needs:

- Rent or mortgage payments

- Utilities (electricity, water, heat)

- Basic groceries (the food you need, not the gourmet cheese you want)

- Transportation (car payment, gas, public transit pass to get to work)

- Insurance (health, car, renters)

- Minimum debt payments (the required minimum on your credit cards, student loans, etc.)

The 30% Bucket: Your Wants

Definition: Your “Wants” are all the non-essential expenses that make life more enjoyable. These are the things you choose to spend money on for fun, comfort, and entertainment.

Up to 30% of your take-home pay can go toward this flexible category.

Examples of Wants:

- Dining out and bar tabs

- Hobbies and gym memberships

- Streaming subscriptions (Netflix, Spotify)

- Vacations

- Shopping for non-essential clothes, electronics, and home goods

- Tickets to concerts and sporting events

This bucket is where you have the most freedom. You get to decide what’s important to you without feeling guilty, as long as it fits within your 30% allotment.

The 20% Bucket: Savings & Debt Repayment

Definition: This is the “Pay Your Future Self” bucket. Every dollar you put here is a direct investment in your financial stability and future goals.

At least 20% of your take-home pay should be dedicated to this powerful category.

Examples of Savings & Debt Repayment:

- Building an emergency fund (aim for 3-6 months of living expenses)

- Contributions to a Roth IRA or other investment accounts

- Saving for a down payment on a house

- Any debt payments above the minimum.

That last point is critical. Making the minimum payment on your credit card is a “Need.” Every single dollar you pay above that minimum is a “Savings” goal because it saves you from future interest payments and accelerates your journey to being debt-free.

How to Put It Into Practice

- Calculate Your Buckets: Take your monthly take-home pay and multiply it by 0.50, 0.30, and 0.20. If your take-home pay is $4,000, your plan is: Needs ($2,000), Wants ($1,200), and Savings ($800).

- Track Your Spending: For one month, don’t try to change anything. Just track where your money goes. Use a simple app or just look at your credit card and bank statements at the end of the month.

- Categorize and Adjust: Sort every expense into one of the three buckets. How does your actual spending compare to your targets? If your Needs are at 60%, that’s a red flag. The framework’s job is to show you where the imbalance is so you can make adjustments, likely by reducing your Wants, to get closer to your goals.

How Credit Cards Fit In

You can and should use credit cards to maximize rewards within this system. Use a cash-back card for groceries (Needs), a dining card for restaurants (Wants), and an all-purpose card for everything else. The key is that the spending itself is budgeted. At the end of the month, you use the money you’ve already allocated in your spending plan to pay the credit card bill in full.

The 50/30/20 rule isn’t a rigid law; it’s a guide. If your numbers are 55/25/20, you’re still making fantastic progress. The goal is not perfection, it’s mindfulness. By giving every one of your dollars a general job, you gain a sense of control that empowers you to build the financial life you deserve.

Frequently Asked Questions (FAQ)

What if my “Needs” are way more than 50%? This is a very common situation, especially in high-cost-of-living areas. The 50/30/20 framework isn’t judging you; it’s providing a diagnosis. It shows that the primary financial challenge is the high cost of necessities, which may require focusing on bigger-picture solutions like increasing your income or long-term changes to housing or transportation.

Where do groceries go? This is a classic example of the rule’s flexibility. The cost of basic food items (bread, milk, eggs, vegetables) is a clear “Need.” The cost of premium, gourmet, or convenience items (imported cheese, expensive snacks, high-end organic foods) might be better classified as a “Want.”

Should I count my 401(k) contributions in the 20% savings? Since 401(k) contributions are typically taken out of your paycheck before you receive it, most people do not count them in their 20% savings target. This makes the rule even more powerful, as it encourages you to save an additional 20% of your take-home pay on top of your automatic retirement savings. For more guidance on saving, you can visit government resources like afsaef.org.

WalletAware shares education, not individualized financial advice. Always confirm current terms on the issuer’s site before applying.