Are you frustrated with your credit score? You pay your bills on time, every single month.

You haven’t missed a payment in years. Yet, your score seems stuck in neutral, never quite reaching that “excellent” tier?

If this sounds familiar, you might be overlooking the second most powerful factor in your credit score—a factor so important it can cause big swings in your score from one month to the next.

It’s called your credit utilization ratio, and understanding it is the secret to unlocking rapid improvement. The best part? There’s a simple guideline to help you master it:

The 30% Rule.

What is Credit Utilization (And Why Is It So Important?)

In plain English, your credit utilization is the percentage of your total available credit that you are currently using at any given time.

It’s a measure of how reliant you are on borrowed money.

According to credit scoring models, this single number accounts for 30% of your entire credit score.

That’s second only to your payment history. As explained in this guide from the University of Illinois Extension, high utilization signals to lenders that you might be financially overextended, making you seem like a riskier borrower. Low utilization signals that you manage credit responsibly.

Mastering this one metric is one of the fastest ways to see a significant jump in your score.

Introducing the 30% Rule: Your Guideline for Success

The 30% Rule is a simple, powerful guideline that says you should aim to use no more than 30% of your available credit limit. This applies to each of your individual cards and to your total credit limit across all your cards combined.

Let’s break it down with some simple math:

- Card A: Has a credit limit of $3,000. To stay under 30%, you should try to keep the balance on this card below $900.

- Card B: Has a credit limit of $5,000. To stay under 30%, you should aim to keep the balance below $1,500.

- Your Total: Your total credit limit is $8,000. To stay under 30% overall, your combined balances should be less than $2,400.

The Drastic Impact: A Before-and-After Scenario

Let’s see how powerful this really is.

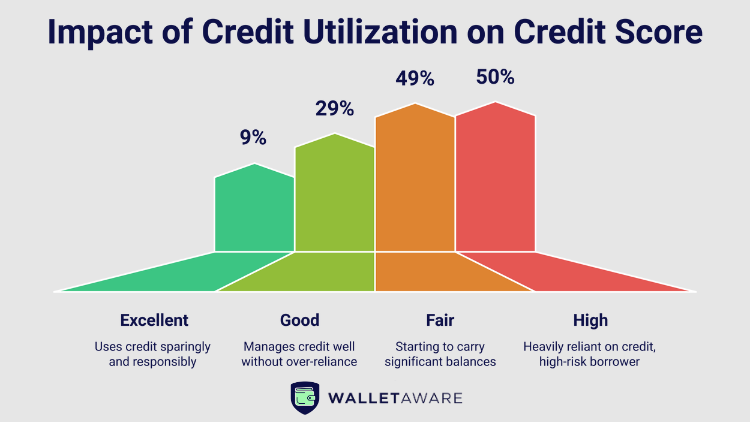

Before: Meet Sarah. She has a perfect payment history, but her credit score is stuck at 660. She has two credit cards with a total credit limit of $10,000. She recently made a large furniture purchase and her current total balance is $5,000. Her credit utilization is 50% ($5,000 / $10,000)—which is considered high.

The Action: Sarah gets her tax refund and makes an aggressive payment, reducing her total balance from $5,000 down to $2,900.

After: Her credit utilization is now a healthy 29% ($2,900 / $10,000). The next time her card issuers report her new, lower balance to the credit bureaus, her score could jump significantly. It’s not uncommon to see an increase of 20, 30, or even 50 points from this one change alone.

3 Smart Ways to Keep Your Utilization Low

- Make Multiple Payments Per Month. Most card issuers only report your balance to the credit bureaus once a month—on your statement closing date. This means even if you pay your bill in full, a high statement balance can still make your utilization spike. To avoid this, make a payment before your statement date to lower the balance that gets reported.

- Ask for a Credit Limit Increase. If your income has gone up or you have a good history of on-time payments, call your card issuer and ask for a higher credit limit. As Cornell University explains, if your limit increases but your spending stays the same, you’ve just cut your utilization in half without spending an extra dime.

- Spread Purchases Across Cards. Instead of putting a $1,000 purchase on a card with a $2,000 limit (50% utilization), consider splitting it. Put $500 on that card (25% utilization) and $500 on another card (assuming it also has a sufficient limit).

The Pro Level: Aiming for Under 10%

While 30% is a great rule of thumb, the data shows that people with the highest credit scores (760+) often keep their credit utilization even lower—typically under 10%.

If you want to optimize your score to its absolute maximum potential, this is the ultimate goal.

The 30% Rule isn’t a strict law, but a powerful lever. By understanding and managing this one simple number, you put yourself in the driver’s seat of your credit health, giving you one of the quickest and most effective tools to build a better score.

Frequently Asked Questions (FAQ)

Does this rule apply even if I pay my bill in full every month?

Yes! This is a crucial point. Issuers typically report the balance that is on your statement when it closes. So, if you spend $1,500 on a card with a $2,000 limit, your statement will close with a $1,500 balance (75% utilization), even if you pay it off completely five days later. Understanding your card’s billing cycle is key to managing the reported balance. Making a payment before the statement closes is the solution.

What if my utilization is high right now? Do I have to wait years for it to get better?

No! This is the best part. Credit utilization has no “memory.” Unlike a late payment, which stays on your report for seven years, the negative effect of high utilization is erased as soon as a new, lower balance is reported. As explained by the Consumer Financial Protection Bureau (CFPB), you can see a score improvement in as little as 30-45 days just by paying down your balance.

WalletAware shares education, not individualized financial advice. Always confirm current terms on the issuer’s site before applying.