Running a business as a student, freelancer, or small business owner can feel like spinning plates—sales, marketing, financing, and keeping your personal money separate from your company’s. One wrong move, and the whole act wobbles.

But here’s the good news: with the right tools, you can simplify your financial life, build credit, and set the stage for long-term growth. Think of these tools as a starter kit for business success.

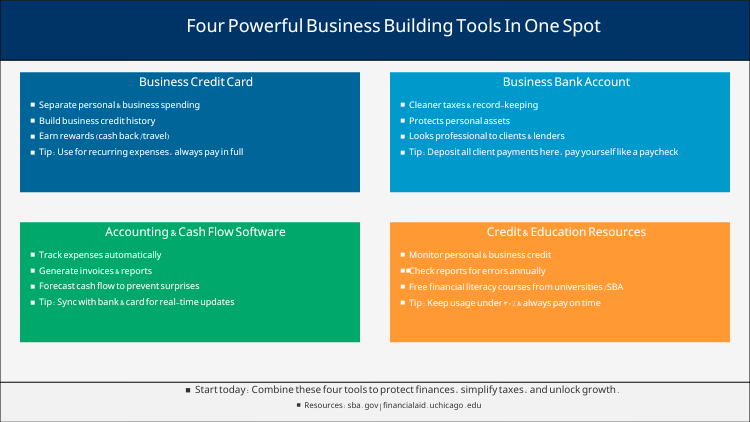

This article lays out four powerful business-building tools you can access in one spot:

- A Business Credit Card (to separate expenses and build credit)

- A Business Bank Account (to track cash flow cleanly)

- Accounting & Cash Flow Software (to stay organized)

- Credit & Education Resources (to protect your score and guide your growth)

Together, these tools form the foundation for business owners who want to grow without the chaos.

Tool #1: The business credit card

A business credit card is not just about making purchases. It’s a record-keeping and credit-building powerhouse. By separating business from personal spending, you:

- Make tax time easier (clear paper trail).

- Build a business credit history (different from personal credit).

- Access rewards tailored for businesses (like cash back on advertising or office supplies).

Breaking down jargon

- APR (Annual Percentage Rate): The interest you pay if you carry a balance. High for business cards (20%+), so pay in full.

- Rewards: Cash back, travel points, or statement credits for spending.

- Intro APR: A low or 0% promotional rate for the first 6–12 months. Helpful for startup expenses, but temporary.

Example playbook

- Apply for a business card with no annual fee to start.

- Put recurring expenses (like software subscriptions) on the card.

- Pay the bill in full each month—builds credit and avoids interest.

- Reinvest cash back or rewards into your business (ads, equipment, or travel).

Best for: Entrepreneurs, freelancers, or side-hustlers who want a clean line between business and personal finances.

Tool #2: The business bank account

A separate business checking account is more than convenient—it’s protection. According to the U.S. Small Business Administration, separating business and personal finances shields your personal assets and builds credibility with customers and lenders.

Benefits

- Cleaner taxes: All income and expenses in one place.

- Professional image: Clients write checks to your business, not you.

- Legal safety: Helps maintain liability protection if you form an LLC or corporation.

Example playbook

- Choose a bank that offers low or no fees for business checking.

- Deposit all client payments into this account.

- Pay yourself from the account—treat it like a paycheck.

- Connect the account to accounting software for automated tracking.

Best for: Any student or small-business owner who wants to avoid messy tax seasons and establish professional credibility.

Tool #3: Accounting & cash flow software

Many businesses fail not because of bad ideas but because of bad cash flow management. Even profitable businesses can run out of money if income and expenses don’t align.

Universities stress this point—Harvard Business School Online highlights that entrepreneurs who monitor cash flow closely are far more likely to survive in competitive markets.

Benefits

- Automated tracking: No more shoebox of receipts.

- Invoicing tools: Get paid faster with professional invoices.

- Forecasting: Spot when cash might run short so you can plan.

Example playbook

- Pick simple software (like QuickBooks, Wave, or FreshBooks).

- Sync your business bank account and credit card.

- Categorize expenses monthly (ads, supplies, travel).

- Use cash flow reports to plan when to reinvest or save.

Best for: Business owners who want to avoid surprises, track growth, and present clean financials to lenders or investors.

Tool #4: Credit & education resources

You can’t manage what you don’t measure. Checking your credit (business and personal) isn’t optional—it’s essential. Lenders, landlords, and even some clients use credit as a measure of trust.

The Consumer Financial Protection Bureau emphasizes two habits that protect your score: pay bills on time and use less than 30% of available credit.

Resources to use

- Annual Credit Report (authorized by federal law) gives you one free personal credit report per year from each bureau.

- Business credit scores can be checked through services like Dun & Bradstreet or Nav.

- Many banks and card issuers also offer free monthly score updates.

Example playbook

- Pull your free credit report each year—check for errors.

- Use your student/business credit card responsibly (on-time, low balance).

- Watch your score grow—higher scores unlock better loan terms later.

- Take free courses on financial literacy from your university or local small-business center.

Best for: Students, freelancers, and small business owners building credit from scratch or rebuilding after setbacks.

Putting it all together: four tools in action

Here’s how these tools work together in practice:

- Business Credit Card: Put your recurring business expenses (ads, subscriptions) here. Earn cash back.

- Business Bank Account: Collect payments and pay yourself. Keeps taxes simple.

- Accounting Software: Sync both card and account for real-time cash flow visibility.

- Credit & Education Resources: Track your score, fix errors, and keep improving your creditworthiness.

This “stack” gives you clarity, protection, and leverage. Instead of drowning in spreadsheets and mixing personal with business, you’ll have a system that scales with you.

Recommendations

- Don’t carry balances on business credit cards—the interest rate will eat your profit.

- Don’t ignore fees—look for free or low-cost checking accounts and cards with $0 annual fee unless rewards justify it.

- Don’t mix funds—treat your business like a business, even if it’s just a side hustle.

- Don’t skip monitoring—set calendar reminders to check cash flow monthly and credit reports annually.

Building a business is tough, but the right financial foundation makes it far less chaotic. By combining a business credit card, a bank account, accounting software, and credit/education resources, you’ll simplify operations, build credibility, and protect your personal finances.

Think of it as building a house: the credit card is your tool belt, the bank account is your foundation, the software is your blueprint, and your credit report is the inspection. Put them together, and you’ve got a structure that can actually stand tall.

For reliable guidance, start with the U.S. Small Business Administration at sba.gov and explore your university’s business or financial literacy resources (like Harvard Business School Online).

With these four tools in one spot, you’ll not only survive but thrive—turning your student hustle or small business into a long-term path to financial freedom.

WalletAware shares education, not individualized financial advice. Always confirm current terms on the issuer’s site before applying.