Picture this: you apply for a shiny new cashback card, imagining all the rewards you’ll earn, only to get an email saying, “We regret to inform you…”

That sinking feeling is frustrating—and it happens to many people. The reason is simple: your credit score wasn’t aligned with the type of card you applied for.

Whether you’re a college graduate, a young professional, or someone rebuilding credit, your credit rating plays the starring role in what cards you can access.

But here’s the empowering part: once you understand how your score and credit cards connect, you’ll know exactly where you stand and how to move forward.

This article will help you:

- Understand what credit ratings mean.

- Learn what types of cards are available at each level.

- Discover how to match your rating to the right card.

- Use practical tips to improve approval odds and build credit responsibly.

By the end, you’ll feel confident about choosing the best personal credit card for your situation—not just for today, but as a step toward your financial future.

A simple breakdown of credit ratings

Your credit rating is like a financial snapshot lenders use to decide if they should trust you with credit. Think of it as your money reputation.The University of Illinois explains credit scores in simple terms, showing how they affect borrowing power and financial opportunities.

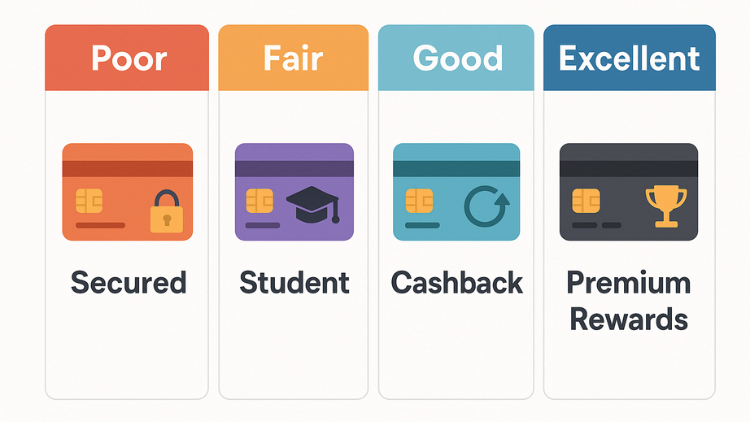

Credit scores usually range from 300 to 850 and are grouped into four categories:

- Excellent (750–850): You’re a lender’s dream. Expect access to the very best offers, including premium rewards cards.

- Good (700–749): You’re considered reliable, but you might miss out on the absolute top-tier perks.

- Fair (640–699): You’re a bit of a gamble for lenders. Options are limited, but you still have opportunities.

- Poor (300–639): Seen as high-risk, meaning you’ll mostly qualify for beginner-friendly or secured cards.

Here’s why this matters:

- Approval odds depend on your score.

- Interest rates (APR) are lower if you have a strong score.

- Rewards and perks are more generous the higher your rating climbs.

In short: a higher credit rating equals better card options and lower costs.

Credit card options for every score range

Not every card is available to everyone. Here’s a breakdown of what’s realistic at each level:

If you have poor or no credit (300–639)

- Secured Credit Cards– You pay a refundable deposit (often $200–$500) which sets your credit limit. These are designed to help you prove you can handle credit responsibly.

- Retail Store Cards– Some retailers offer cards with lower approval standards, but beware of high interest rates.

Example: Maria, just out of college with no credit history, gets a secured card with a $300 limit. She uses it for groceries and pays it off monthly. Within a year, her score improves enough to qualify for an unsecured rewards card.

If you have fair credit (640–699)

- Student Cards – Great for young professionals and college graduates, often with simple perks like 1% cashback.

- Basic Rewards Cards – Some banks extend entry-level cashback or point-based cards to fair-credit applicants.

Example: David, with a score of 680, qualifies for a student cashback card offering 1% back on purchases. It’s not flashy, but it starts building a positive history while rewarding his spending.

If You Have Good Credit (700–749)

- Cashback Cards – Earn 1–5% on purchases like groceries, gas, or dining.

- Travel Rewards Cards – Collect miles or hotel points. Ideal for those who travel occasionally.

- Balance Transfer Cards – Allow you to move debt from high-interest cards to a new one with 0% intro APR, saving money on interest.

Example: Sarah, with a 720 score, transfers her $2,000 balance to a card offering 0% interest for 18 months. She saves hundreds in interest and pays down her debt faster.

If you have excellent credit (750–850)

- Premium Rewards Cards – Think airport lounge access, luxury travel perks, and big sign-up bonuses.

- Low-Interest or 0% APR Cards – You’ll qualify for the lowest borrowing rates available.

Example: James, with a score of 780, applies for a premium travel card. He earns a 60,000-mile bonus, enough for an international flight, simply by meeting the spending requirement.

Matching the right card to your score

Here’s a simple way to avoid frustration: choose a card that matches where you are, not where you want to be.

Think of it like applying for jobs. If you’re fresh out of school, you wouldn’t expect to land a CEO position—you’d start with an entry-level role and work your way up. Credit cards are the same.

- 300–639 (Poor): Stick to secured cards. They’re stepping stones.

- 640–699 (Fair): Apply for student or basic cashback cards.

- 700–749 (Good): Target solid rewards, travel, or balance transfer cards.

- 750+ (Excellent): Go for premium rewards or luxury perks.

Matching your score to your card prevents unnecessary rejections and protects your credit rating from hard inquiries.

Smart ways to improve your odds

Always pay on time. This is the single biggest factor in your score (35%). According to the Consumer Financial Protection Bureau, even one late payment can negatively impact your credit history.

Even if you’re not in the “excellent” range yet, there are reliable ways to increase your approval chances:

- Check your score before applying. Free tools like Credit Karma or your bank’s app make this easy.

- Limit applications. Every “hard inquiry” dings your score slightly. Apply only for cards that match your profile.

- Pay bills on time. This is the single biggest factor in your score (35%).

- Keep balances low. Aim to use less than 30% of your available credit. Example: if your limit is $1,000, try to keep your balance below $300.

- Move up gradually. Start with a secured card, then switch to unsecured once your score improves.

A simple habit—paying your balance in full each month—not only boosts your score but also saves you from paying interest.

Key takeaways: your next steps

Here’s your quick playbook for choosing the best personal credit card:

- Know your credit score. Don’t guess—check it.

- Identify your range. Poor, fair, good, or excellent.

- Match your range to card types. Apply where you fit.

- Compare 2–3 card options. Look at fees, rewards, and APR.

- Apply strategically. One good application beats several random ones.

- Use responsibly. Pay on time, keep balances low, and your score will grow.

Moving forward with confidence

Your credit rating isn’t a permanent label—it’s just your starting point. Whether you’re at 580 or 780, the right card is out there for you. Choosing wisely now builds the foundation for stronger financial opportunities later.

Remember: the best personal credit card isn’t the one with the flashiest perks—it’s the one that fits your current situation and helps you build toward the future you want.

You’re in control, and every smart choice moves you closer to financial freedom.

WalletAware shares education, not individualized financial advice. Always confirm current terms on the issuer’s site before applying.